|

Field

|

Description

|

|

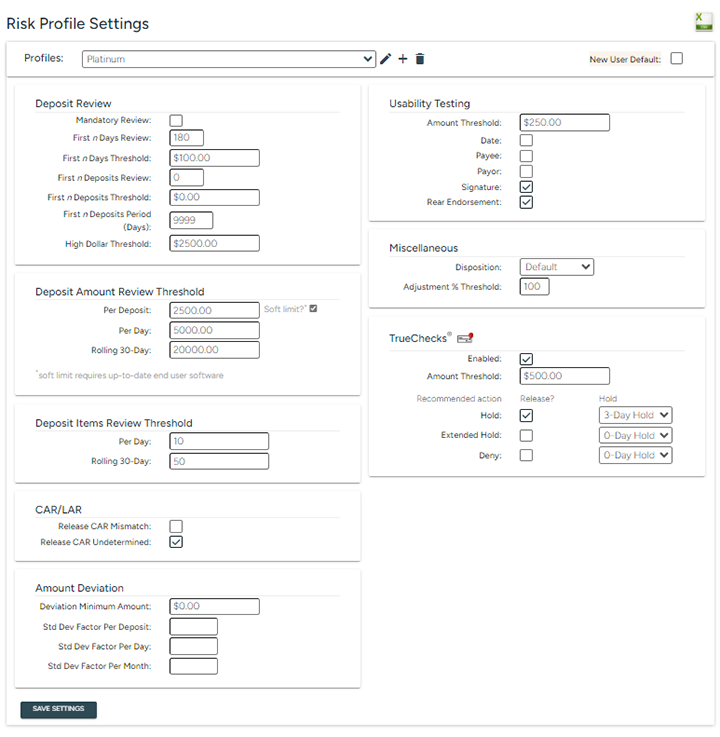

Mandatory Deposit Review

|

Option to require a mandatory review of all end users' deposits (who are associated with a risk profile that has this flag enabled).

|

| First n Days Review |

The number of days after registration by new end users that deposits are automatically flagged for review, based on the First n Days Threshold (see below). For example, if First n Days Review is set at 180 then any deposit made within the first 180 days after registration will be flagged for review, if they exceed the First n Days Threshold. The default value for this field is zero (0), which disabled this feature. To enable, enter a number greater than zero. |

| First n Days Threshold |

Dollar threshold for which First n Days Deposits will not get held for review (i.e. if the deposit is below this amount, it will not be held for First n Days Review). |

|

First n Deposit Review

|

The number of initial deposits made by new end users that are automatically flagged for review, based upon the First n Threshold (see below). For example, if First n Deposit Review is set at three (3), then the first three deposits for each registered end user will be flagged for mandatory review, if they exceed the First n Threshold. The default value for this field is zero (0), which disables this feature. To enable, enter a number greater than zero.

Note: The First n Deposit Review feature is based upon the most recent 18 months of deposit history, unless the First n Periods (Days) feature is enabled for a lesser number of day.

|

| First n Deposit Threshold |

Dollar threshold for which First n Deposits will not get held for review based upon this setting (i.e. if the deposit is below this amount, it will not be held for First n Review). This threshold works hand-in-hand with the First n Deposit Review feature.

Note:

- When using this feature, if a deposit less than this value is not held for review due to this threshold (i.e. the value of the deposit is less than this threshold), it does not get counted towards the value established in the First n Deposit Review field.

Illustration:

First n Settings

First n Deposit Review = 3

First n Threshold = $50.00

Deposits Made

Deposit #1 = $25.00; not counted towards First n Review

Deposit #2 = $30.00; not counted towards First n Review

Deposit #3 = $35.00; not counted towards First n Review

Deposit #4 = $100.00; exceeds First n threshold; item is held for review

In the example above, since one or more of the initial end user deposits was valued less than the First n Threshold value, Deposit #4 will be held for review based upon the First n Deposit Review setting.

|

| First n Period (Days) |

Specify how many days must have passed since the end user's last deposit before their new deposits are again flagged for review. If an end user's most recent deposit(s) in history are all prior to the number of days specified, the First n Deposit Review feature will reset and be applied to the next deposit(s) made (i.e., the deposit(s) will be held for review based upon the First n Deposit Review setting). This setting is dependent on the First n Deposit review feature.

Note:

- To apply all deposits in history towards the First n Deposit Review period (i.e. full 18 months' history), enter 9999 into this this field.

|

|

High Dollar Threshold

|

The dollar value that triggers an automatic review of checks. Any deposit (made by a user in the specified risk profile) which contains a check that meets or exceeds the High Dollar Threshold will be flagged for automatic review.

|

|

Per Deposit Amount Threshold

|

The maximum dollar amount permitted for a single deposit.

|

| Per Deposit Amount Threshold - Soft Limit? |

Check the box next to "Soft Limit?" to allow end users the ability to submit deposits over their per deposit amount threshold.

Note: This feature requires use of version 9 or greater of Vertifi's RDC Mobile technology, or the RDC Desktop (downloadable) Application for end user deposits.

|

| Daily Deposit Amount Threshold |

The maximum dollar amount permitted for a single day before requiring the deposit to be held for administrative review/release. |

|

Rolling 30-Day Deposit Amount Threshold

|

The maximum dollar amount permitted for a 30-day period before requiring the deposit to be held for administrative review/release.

|

|

Daily Deposit Item Threshold

|

The maximum number of deposit items permitted for a single day before requiring the deposit to be held for administrative review/release.

|

|

Rolling 30-Day Deposit Item Threshold

|

The maximum number of deposits items permitted for a 30-day period before requiring the deposit to be held for administrative review/release.

|

|

Release CAR Mismatch

|

This box is unchecked by default; leave this box unchecked if the system should hold a submitted item for review/release by an administrator for which a user-entered amount "mismatches" the amount identified by the DeposZip software (i.e. derived value). E.g., if a user enters a value of $10 but the derived value is $100, the check will be held for review.

Alternatively, check this box if the system should automatically release a submitted item for which a user-entered amount "mismatches" the amount identified by the DeposZip software (i.e. derived value), and there are no other errors associated with this item that would cause it to be held for review.

|

|

Release CAR Undetermined

|

This box is checked by default; leave this box checked if the system should automatically release a submitted item for which the amount cannot be identified by the DeposZip software. Note: this auto-release will only occur if there are no other errors associated with this item that would cause it to be held for review.

Alternatively, uncheck this box if the system should hold a submitted item for review/release by an administrator for which the amount cannot be identified by the DeposZip software.

|

|

Deviation Factors

|

Standard deviation is a simple measure of the variability of a data set. When used for analyzing deposits, standard deviation tests can indicate how far from the mean, or average, a particular deposit value is for a specific end useruser.

|

|

Usability Testing

|

Usability testing is the process of identifying the presence of information in a specific location of a check image. Usability tests can be turned on or off by field. Placing a checkmark next to the field enables the test, while an unchecked box disables the test.

Administrators can also set a dollar limit (i.e. Usability $ Threshold) to test only items that meet or exceed this amount, and disregard these tests on items that fall below the amount entered.

The fields that can be enabled for Usability testing are:

-

Date

-

Payee

-

Payor

-

Signature

-

Rear Endorsement

Enter an amount in the Usability $ Threshold field, and place a checkmark next to each field you wish to run the Usability tests for. Any item that fails a Usability test(s) will be held for administrative review for that reason.

Note: The Rear Endorsement test must be enabled (i.e. have a checkmark) if using the Vision rear endorsement validation feature.

|

|

Disposition

|

Item disposition override. When set to Default, the system disposition tables will be used. When a value other than Default is selected, that value will be applied to all deposit items from end users associated with this risk profile.

|

|

Adjustment % Threshold

|

The minimum percentage of deposit (amount) adjustments on an end useruser account required to trigger automatic review. If the current adjustment percentage (number of adjustments divided by total deposits) exceeds the defined threshold, the deposit will be held for review. This percentage is calculated as each deposit is submitted by the end useruser. The default value for this field is 100, which disables this feature. To enable, enter a number (percentage) less than 100.

|

|

TrueChecks - Amount Threshold

|

Select a dollar value for items in this risk profile to query the TrueChecks fraud detection database; any item that meets or exceeds this value will be sent to TrueChecks.

|

|

TrueChecks - Release?

|

Check the box next to a Recommended Action category (Hold; Extended Hold; or Deny) to automatically release items that return an alert from TrueChecks for that specific Recommended Action. If the Release? checkbox is not checked, items that meet the amount threshold (see above for details) and which are returned by the TrueChecks database with that specific Recommended Action will be held for administrative review.

e.g.: If the Release? checkbox next to the Recommended Action of "Hold" is checked, and an item returns results from the TrueChecks database for this recommended action due to the reason Uncollected Funds, the item will automatically release so long as no other risk criteria are triggered. The Hold timeframe associated with this category (see below for details) will be assigned to this item.

|

|

TrueChecks - Hold

|

Select a hold timeframe for each Recommended Action category (Hold; Extended Hold; or Deny). Accepted items (both auto-released and admin released) that return an alert for a specific Recommended Action will use this hold timeframe in either the real-time posting message, or batch posting file sent to your core processor.

Note: Hold values may be fully automated only if your financial institution's core processor recognizes and acts upon those hold values as sent from Vertifi; some programming may be required to achieve full automation. Hold values are not supported with the CSV Detail or X9.37 file formats.

|